🔧 What Are Fixed Assets?

Fixed assets are long-term physical assets used in the operations of a business. Common examples include:

-

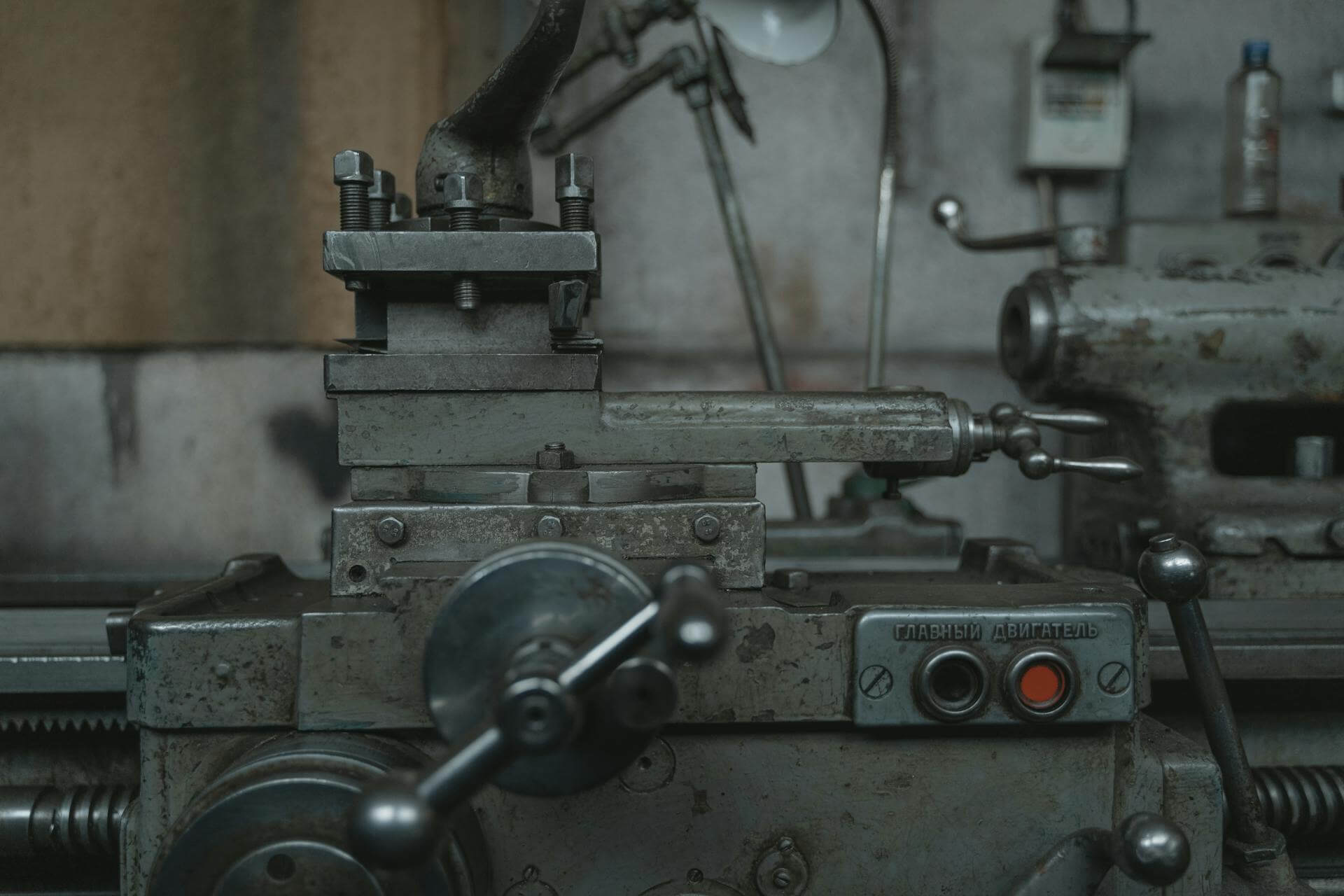

🏭 Manufacturing or warehouse equipment

-

🪑 Office furniture and fixtures

-

🚚 Commercial vehicles

-

💻 Technology and computer systems

-

🏢 Building improvements or real estate

These assets are not expected to be consumed or converted to cash within one year and typically depreciate over time.

💰 Option 1: Equipment or Term Loan

A term loan is a lump sum provided by a lender, repaid over time with interest. When used to purchase fixed assets, it’s often referred to as an equipment loan.

✅ Advantages of Equipment Loans

-

💸 Ownership: You own the asset from day one

-

💰 Depreciation Deductions: Eligible for Section 179 and other tax benefits

-

📉 Lower Long-Term Cost: Typically less expensive than leasing

-

📊 Fixed Payments: Predictable budgeting and cash flow

-

🏦 Asset as Collateral: May improve chances of approval

⚠️ Disadvantages of Equipment Loans

-

🔐 Upfront Down Payment: Often requires 10–20% down

-

⏳ Long-Term Commitment: You’re responsible for outdated or obsolete assets

-

📉 Depreciation Risk: Value may drop faster than expected

-

🧾 Capital Tie-Up: Reduces liquidity for other needs

🤝 Option 2: Equipment Leasing

Leasing allows your business to rent equipment for a specific term. At the end of the lease, you may return, renew, or buy the asset—depending on the lease agreement.

✅ Advantages of Leasing

-

💸 Lower Upfront Cost: Often no or low down payment

-

🔄 Technology Flexibility: Easier to upgrade or swap equipment

-

📉 Off-Balance Sheet Option: Operating leases may not count as liabilities

-

🧾 Tax-Deductible Payments: Lease payments often fully deductible

⚠️ Disadvantages of Leasing

-

💰 Higher Long-Term Cost: Leasing usually costs more over time

-

🔐 No Ownership: No equity or asset value gained

-

🧾 Contract Obligations: May include rigid terms or penalties

-

📉 Usage Restrictions: Limitations may apply (e.g., mileage limits)

⚖️ Lease vs. Loan: Side-by-Side Comparison

| Feature | Equipment Loan | Equipment Lease |

|---|---|---|

| 💳 Upfront Cost | Medium (10–20%) | Low to None |

| 🏢 Ownership | You own it | You rent it |

| 📉 Depreciation | Business benefit | Lessor benefit |

| 💡 Flexibility | Low | High |

| 💰 Total Cost | Lower long-term | Higher long-term |

| 🧾 Tax Impact | Depreciation write-offs | Lease payments deductible |

| 🔄 Upgradability | Limited | Easier to upgrade |