Discover how a well-structured term loan can help your small business grow—smartly and sustainably.

What Is a Term Loan?

A term loan is a lump sum of capital provided by a lender, repaid over a fixed period—typically between 1 and 10 years—at a fixed or variable interest rate. It’s commonly used for long-term investments such as real estate, renovations, hiring staff, or upgrading technology.

Banks, credit unions, and online lenders typically offer these loans, which may require collateral or a personal guarantee.

Benefits of Using a Term Loan for Expansion

-

Access to Larger Capital: Perfect for large expansion projects beyond the limits of credit cards or lines of credit.

-

Predictable Payments: Fixed rates and repayment schedules make budgeting easier.

-

Supports Long-Term Growth: Ideal for strategic, multi-year business investments.

-

Builds Business Credit: Timely payments help establish your creditworthiness.

-

Lower Interest Than Short-Term Alternatives: Term loans often have more affordable interest rates compared to short-term debt.

Common Ways Businesses Use Term Loans to Expand

| Use Case | Description |

|---|---|

| Open a New Location | Fund leasehold improvements, inventory, and staff for a new branch or office. |

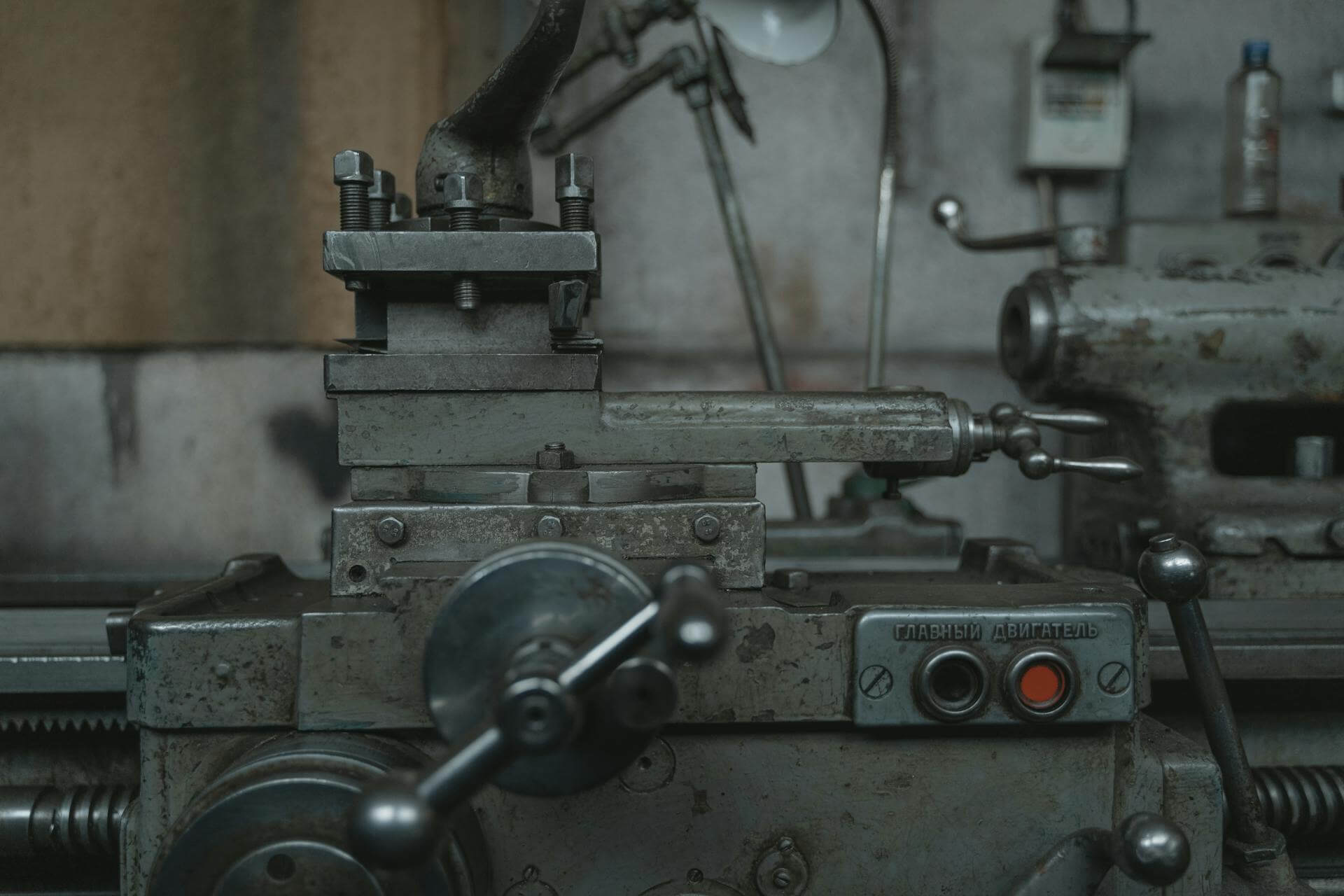

| Purchase Equipment | Invest in production tools, technology, or vehicles to increase efficiency. |

| Hire & Train Employees | Grow your team ahead of rising demand. |

| Stock Inventory | Prepare for peak seasons or new product launches. |

| Marketing & Branding | Launch campaigns to grow your customer base. |